It’s best that you know which the main team are for it services to always’re also using a dependable service when they appear on your cellular mobile phone bill. If you are using your financial institution’s certified app, the monetary info is properly encoded. Your info is became an enthusiastic unreadable password since it is distributed to your standard bank digitally.

Create Pay By the Cellular casinos accept almost every other financial actions?: read this

However, the cash may not be readily available for a couple of hours in order to a few days, dependent on your own seller’s principles. However,, the fresh put limits about this element will get sway the choice of the bank. You could log in to the fresh software and you can accessibility your profile securely 24/7 using the latest technology as well as Touching ID and single-fool around with shelter rules. Same as no deposit incentives in your favourite casino, no-deposit incentives on the mobile is precisely the same thing having the newest exclusion out of stating it via mobile. Such incentives are also given as the welcome incentives and they are readily available in the Windows, Android os or Apple apple’s ios devices.

Excite comment its terms, confidentiality and you can shelter principles to see the way they apply at your. Pursue isn’t responsible for (and will not render) people things, read this features or articles at this 3rd-team website or application, with the exception of services and products you to definitely explicitly bring the brand new Chase label. Observe how without difficulty you might put a from the comfort of your portable — rapidly, conveniently, and with mobile put inside our cellular banking app.

Correspondent Functions

For additional facts, see TD Bank’s Financing Access rules. Deposit the cash into the loved one otherwise friend’s account and they’ve got the fresh freedom to expend the bucks on the calls or any other communication characteristics offered by its studio. In such cases, the amount of money won’t be around up until pursuing the financial recommendations the new put. Just after all of our remark, you can aquire a letter from the send for the choice. To get going, name among the playing banking institutions or credit unions listed on the new VBBP web site.

Earliest, make sure your lender or borrowing from the bank union also offers cellular consider deposit. If it does, this site can sometimes render an install relationship to the brand new bank’s cellular application. Download the brand new application on to a smart phone having a cam—Android, new iphone 4, and Windows gizmos are usually offered. Vary from your financial’s web site to ensure that you get the fresh genuine application rather than just an impostor. Be sure to understand and you may learn their provider’s principles ahead of using the newest cellular deposit feature to avoid any issues or waits.

To own mothers with children and family, discuss Pursue Twelfth grade Checking℠ or Chase Basic Financial℠ while the a merchant account that helps parents instruct decent money habits. All of our Pursue College or university Examining℠ membership features great benefits for college students and you may the newest Pursue examining users will enjoy that it special provide. Cellular view put try an assistance that allows you to put a into your membership using your smart phone with out to in person go to a location individually. GTL’s Put Solutions do efficiencies when taking deposits, lose correctional studio can cost you, and increase the convenience to own relatives and buddies participants. GTL now offers an over-all set of issues to select from thus that best blend might be made for the studio.

Rebecca Lake is actually an authorized educator in the personal finance (CEPF) and you can a banking specialist. This woman is started referring to personal finance because the 2014, and her work has appeared in numerous courses on the web. Beyond banking, the girl possibilities talks about borrowing and you may financial obligation, college loans, spending, real estate, insurance policies and business. Yes, you can while the all the Shell out By Cellular choices just lets places. You will be prompted to choose some other percentage strategy whenever your demand a withdrawal.

- For many who discovered a that isn’t produced out over your, best practice should be to feel the look at supported because of the payee and then deposited to their very own membership.

- You might put checks into the membership simply by delivering a picture of your own report look at by using the mobile app.

- Through to request away from Lender or Merrill, you will punctually deliver the Product to Financial or Merrill during the the new Maintenance Several months.

- Chase on line lets you control your Pursue membership, consider comments, monitor hobby, make ends meet or import finance properly from a single central put.

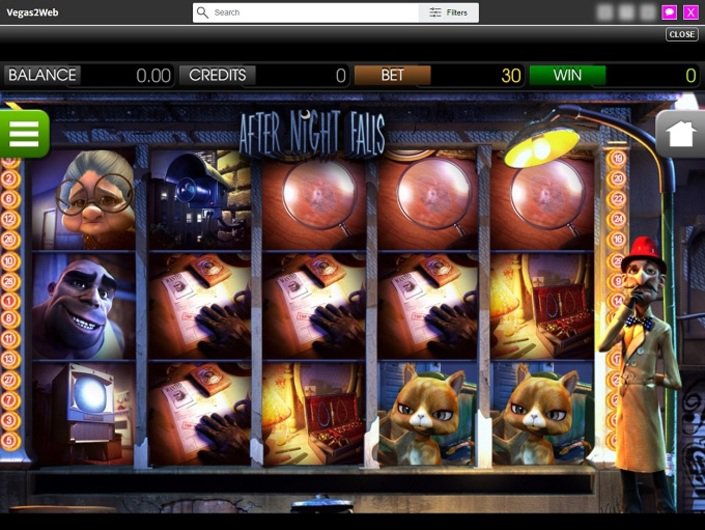

- You could potentially go to one of those internet sites and pick online game off their number.

- There are even other activities to appreciate whilst you gamble in the an on-line gambling enterprise.

- The fresh liberties and you may responsibilities here will join and you will inure for the benefit of any assignee.

ET cutoff day will be felt gotten for the after the business time. Pursue QuickDeposit now offers a simple and easy way to put monitors through the Pursue mobile software, saving you from having to see a bank part or Atm. For those who’re not used to Pursue, you have questions relating to the way the application works.

How to install lead deposit?

- Imagine each other pros and cons before deciding if the pay from the mobile phone is the best choice for you.

- Watch out for qualifications, keep episodes and you will charges while they can differ from in the-part banking.

- Such, the fresh Wells Fargo cellular software explains the mobile put restriction once you come across a merchant account and you can enter the wanted deposit matter.

- Such, Bank away from The united states also provides mobile look at places and usually techniques financing becoming offered the following working day.

- Fund are often available immediately after deposit but could possibly bring multiple business days to pay off.

- We’re dedicated to creating responsible gambling and increasing sense regarding the the newest you can risks of gambling addiction.

For many who have your mobile family savings establish, log on to mobile banking. Come across cellular take a look at put in action with this interactive lesson. Make sure you keep your register a safe place until you comprehend the full put amount placed in your account’s earlier/recent transactions. After you do, be sure to ruin the newest look at instantly from the shredding they otherwise using some other safe approach. There is certainly a monthly limit to have Mobile Consider Places and it’s really exhibited after you discover the deposit account.

One of the biggest benefits associated with mobile banking, and especially cellular take a look at places, ‘s the independency that it brings. You are no more linked with a physical place for an excellent key part of debt demands, and many financial institutions offer this service with no more charge. From the banking industry, this type of digital transactions try described as secluded deposit bring. They’re canned in person from bank’s digital program, and the study you send are included in security.

Navy Government Guidance

Mobile deposit is actually a method to deposit a instead of myself visiting the lender. By using a mobile device which have a cam—for example a smartphone otherwise a supplement—you can bring a graphic of the consider, that’s then published through the bank’s mobile app. Cellular places are often removed in this an issue of weeks. Attempt to check your banking contract to your exact form of inspections their establishment have a tendency to approve to own mobile deposit. Really will let you put personal checks, organization monitors, and regulators monitors.

This way, you have the check up on hand-in situation something goes wrong during those times. When you check and upload the fresh photographs of your view and you can fill out your own put demand, all the details are encrypted and you may transmitted to the lender. The brand new look at then observe the standard tips to possess processing and you can clearing and so the financing can also be deposit to your membership. If you wish to heed equivalent commission tips using only your cellular, you can look at Siru Mobile, PayForIt otherwise Boku.

Ally offers effortless, totally free and safer on line take a look at deposits as a result of Friend eCheck℠ Deposit. The same as other financial institutions, Friend provides a number of limitations for instance the consider need to be dated in the last 180 weeks and you will deposit upwards to $50,one hundred thousand instantaneously and up to $250,100000 the 30 schedule days. If you are a friend customer for over 31 months, you’ll receive much more quick access for the money and that is of use if you want to make swift costs. At the same time, cellular consider places arrive due to on the internet-merely banking companies such Friend and you can SoFi, along with of many borrowing unions. On the increase out of electronic financial, consumers are now able to done of many preferred financial characteristics on the web or using a good bank’s mobile app, as well as depositing monitors.